Dubai is known for its shopping festivals and plenty of tourists from the region visit during these seasons in order to maximize their visit and purchase goods and items. For UAE travellers, did you know that you can process a tax refund at the airport? Here’s a guide to help you.

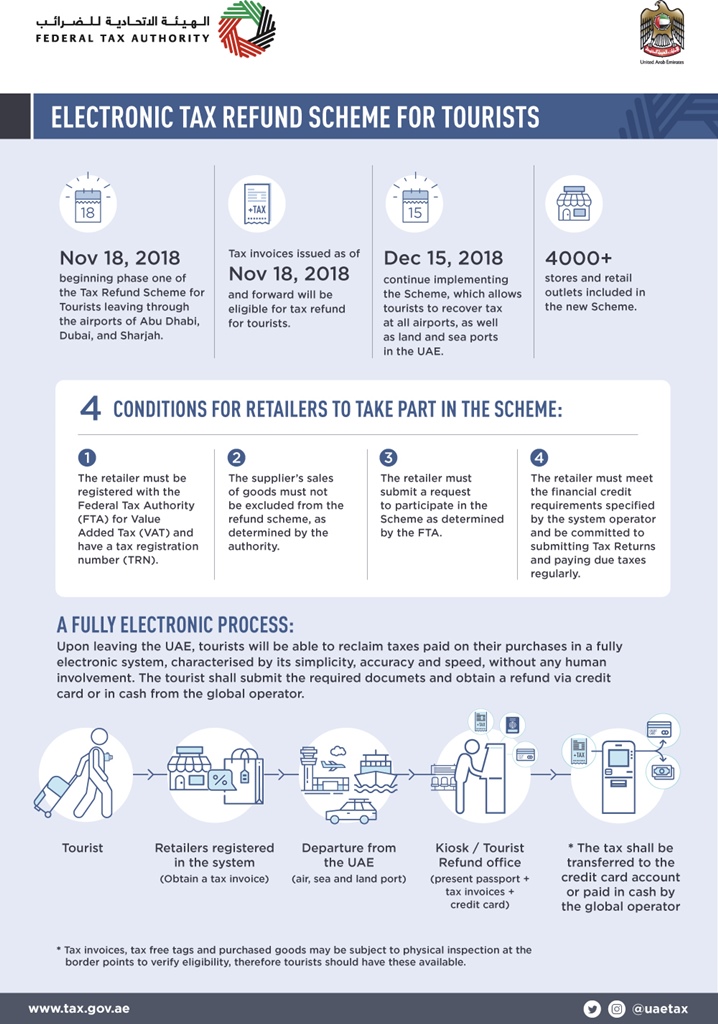

VAT system was implemented throughout the GCC countries last January 1, 2018. However, for those who are not aware it was only on November 18, 2018, when VAT refund for tourists was enforced.

While the VAT rate is only 5%, the tax accumulation of your purchase goods throughout your stay in UAE can become a big sum of money that thankfully you can claim your tax refund later. You may refer to the following information to learn more about the VAT system and the conditions that apply to be viable for a refund.

Contents

Things You Need to Know About the VAT Tax in UAE

You can check out some guidelines about VAT and how you can apply if you are visiting Dubai or the UAE. We will discuss what it is, and how and where to claim the refund.

What is Value Added Tax?

It’s a fee that is paid through the purchase of goods in certain stores and services. The sum of money collected is used for the improvement and maintenance of facilities and infrastructures of UAE.

While UAE is known as the greatest resource of the oil industry which leads to the country’s prosperity, the recent decline of GDP lead to the conclusion that the regulation of UAE’s economic needs will be at risk.

While the news is alarming, the government ensure only 5% for the VAT rate, a fee which is sufficient enough to help the country’s needs but not as much as it would affect the lifestyle of the citizens.

VAT Tax Refund for UAE Tourists

As mentioned earlier, there’s a tax refund for the tourists of UAE. As long as you buy items through registered stores across the country, you’ll be able to claim the VAT you paid for upon exiting the country.

While UAE pushes the VAT movement for the economy’s beneficial, the exemption of the rule to tourists is believed as a way to boost the country’s tourism, encouraging the tourists to purchase more goods without worrying added tax to their receipts.

Who are Eligible for VAT Tax Refund?

If you noticed, I mentioned that items or services should be bought through stores registered under the VAT tax refund. Certain stores across the country will have posters outside their establishment to inform tourist whether they are under the tax refund system or not.

Other than that, the following are the criteria that must be met to have a tourist tax refund.

- The item/s should be supplied from UAE

- You should make sure that you’ll be exiting the country with the item within 90 days upon purchase.

- Goods should belong to the tax refund system of UAE.

Step by Step: How to Claim VAT Tax Refund in Airport

Now that you know the qualifications needed to be accepted under the tax refund law, you will now proceed to learning how to claim it. Where to claim the refund? You can do so electronically via the airport of departure.

- Tax invoice. Make sure that you will receive a tax invoice to the registered store where bought your item.

- Submit and Claim. Give the documents to the system operator, to whom you will also receive the refund.

- Present documents. Tax invoice, passport and your credit card will be needed to transfer the money to you.

For the aspiring visitors of UAE, I hope this will help make your future trip here easier when it comes to your VAT Tax refund claiming. Here’s an infograph to guide you which is posted by the Federal Tax Authority in UAE: